EV stocks surged higher this year as investors hoped for the Chinese economy to reopen. NIO Inc. ( NYSE:NIO ) and other EV companies strongly in January, but have recently surrendered most of those gains as fundamentals and recent developments changed the outlook for the industry.

Tesla Inc. (TSLA) is increasing the pressure on the EV competition in China by recently lowering prices for its most popular electric vehicle models, which could lead to other EV companies following Tesla’s lead.

I believe that investors are still too optimistic about the prospects in the electric vehicle industry, China reopening or not and I continue to think that NIO’s stock is probably reasonably valued at around $10.

Hence, I would caution investors against buying the drop in NIO’s stock. Slowing growth, production issues as well as ADR de-listing risk played a key role in driving NIO’s stock to ~$10. With that said, a new set of challenges has cropped up that I think will curtail NIO’s upside potential.

A Look At The Chart Profile

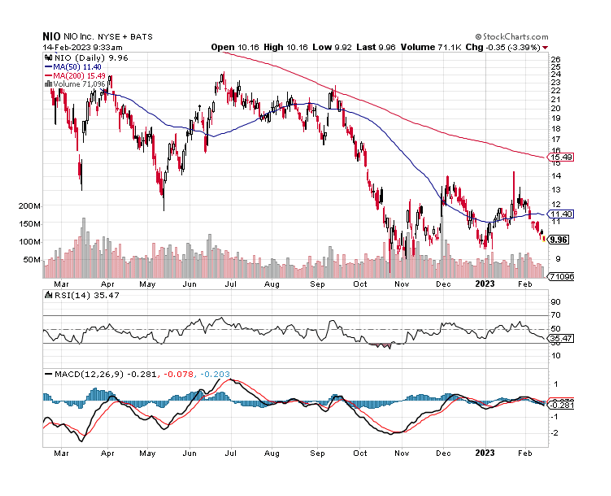

A $10,000 investment in NIO made a year ago is now only worth $4.3K, representing a 57% decline. The decline in NIO’s stock price has been precipitated by a couple of interconnected influential factors that investors following the EV sector are well aware of: Covid lockdowns, primarily, but also secondary reasons such as supply-chain issues and a drop in demand for electric-vehicles. The last factor in particular has been a major catalyst for NIO’s downswing since January.

From a technical chart perspective, NIO broke out above the 50-day moving average line in January which was a bullish signal in the short term, but the stock has recently crashed through the 50-day moving average, lending fresh downside momentum to NIO. According to the Relative Strength Index, the stock is close to being oversold.

NIO Deliveries And Resetting Of Growth Expectations

NIO had a very difficult year in 2022, despite a nice rebound in delivery growth, particularly in the last two months of the year.

NIO delivered 15,815 electric-vehicles in December, representing a 50.8% YoY growth rate. But NIO delivered just 8,506 electric-vehicles in January 2023, indicating that the electric-vehicle sector is taking a substantial demand hit.

Even though the December growth rate of 50.8% appeared to be quite robust, NIO’s delivery growth has slowed dramatically throughout 2022. Last year, NIO delivered 122,486 electric-vehicles in total, reflecting just 34.0% YoY growth, but just a year earlier NIO achieved a growth rate of 109.1% and delivered 91,429 electric-vehicles. In the year prior to that, in 2020, the delivery growth rate was 112.6% YoY and the company delivered 43,728 electric-vehicles in total.

NIO’s annual delivery growth has therefore slowed from triple digits in 2020 and 2021 to just 34% in 2022 amid a slew of challenges including factory closures, Covid-19 outbreaks and a messed up supply-chain.

The EV sector also has become a much more crowded field in 2022 and Tesla is challenging companies like NIO in their home market with aggressive price cuts. Thus, a slowdown in delivery growth must be expected in 2023 and NIO may very well see lower margins as a consequence.

I think a renewed warning about slowing growth and softer margins is in order because China is reopening its economy and some investors may pin their hopes on a strong recovery in EV sales/deliveries which I just don’t see.

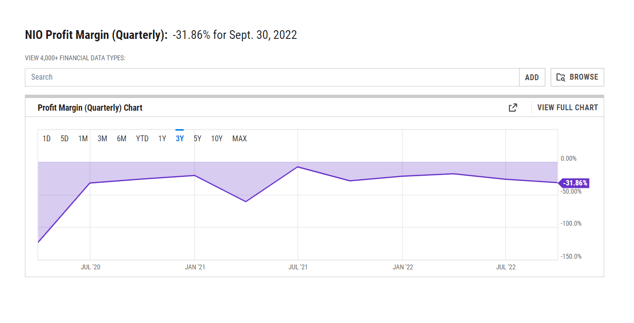

Even though I think there might be some stimulus for Chinese EV companies from a reopening in the short-term, the broader picture points to more pressure on the sector, particularly because of Tesla’s new pricing strategy (see following section). NIO is still losing a lot of money each quarter, a situation which could be made worse by Tesla.

NIO’s profit margins were negative 32% in third quarter and I doubt that the profit situation has much improved in the fourth quarter. Tesla’s pricing strategy may add further profit pressure for NIO, particularly if the company is forced to also lower its prices.

Tesla’s Price Decreases For Popular Models Could Result In A Price War In The EV Sector, Suppressing Valuations

Sluggish demand for electric-vehicles appears to be a bigger issue than investors believe right now, which isn’t surprising. NIO is a growth company, and investors in sexy growth companies never want to hear that growth is slowing.

The demand slump is made worse by industry-leader Tesla which announced in January that it is slashing prices for the popular Tesla Model Y and Model 3 to counteract falling demand for electric-vehicles. Prices for these models are dropping by 6.0-13.5%, which is expected to boost Tesla’s EV sales in China.

Demand for electric-vehicles is slowing, in part because Beijing is discontinuing cash subsidies for EV purchases, a policy that has allowed EV companies to sell more vehicles than they would have otherwise.

A stronger bargaining position for buyers and a better value offer from Tesla could put pressure on other EV companies, like NIO, to follow suit, potentially igniting an EV price war that only the strongest and most profitable companies can win.

Premium Valuation Is Not Deserved

EV investments were hot in 2020 and 2021, but they are no longer, which is why NIO is down 84% from its all-time high.

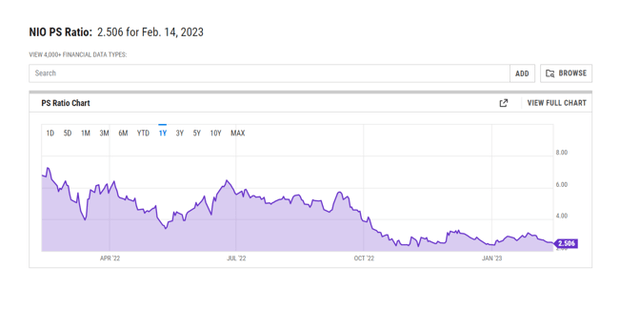

Having said that, NIO’s sales potential is currently valued at a sales multiple of 2.5x, which I believe is excessive given NIO’s slowing sales growth, rising competitive pricing pressures, and the disappearance of EV subsidies in China.

Společnost XPeng Inc. (XPEV) is trading at a sales multiple of 1.7x whereas BYD Company Limited (OTCPK:BYDDF) trades at 1.8x sales. There are differences in size and market orientation for these companies, but broadly speaking, comparable EV companies are trading at lower sales multiples than NIO.

The sales multiple is also excessive, in my view, particularly because NIO is not profitable and continues to post rather large losses. NIO is many years away from profitability and the company posted a 3Q-22 net loss of RMB4.1 billion (US$577.9 million) in the third quarter. I am also skeptical of NIO’s valuation in light of Tesla’s price actions which are creating more sales pressure for NIO.

Why NIO Might See A Higher Stock Price

There is a chance that demand for electric-vehicles will resurface, maybe in the context of China’s reopening, but this would probably not address the issue of rising electric-vehicle prices and the possibility of a price war in the EV sector.

There is also the risk of ongoing production bottlenecks, as there are still some supply-chain issues that plague the sector. Considering NIO’s high sales valuation, I think the risk/reward tradeoff is unappealing.

Můj závěr

The theme of a grand reopening of the Chinese economy, which sparked some interest in EV stocks in January, does not hold up under scrutiny. The truth is that NIO’s sales growth has slowed significantly last year and will most likely continue to slow as the Chinese EV industry develops.

Tesla’s price cuts for its most successful models in China demonstrate that the U.S. company is facing a demand problem, and the price cuts were implemented to drive sales that would not have occurred at a higher price point. If the price war spirals out of control, NIO will have to deal with even slower delivery and sales growth moving forward.

With a P/S-ratio of 2.5x, I continue to believe that NIO’s growth potential is overvalued, and I would advise against investing. The fair value is still around $10.

Poznámka editora: Tento článek pojednává o jednom nebo více cenných papírech, které se neobchodují na hlavní burze v USA. Buďte si prosím vědomi rizik spojených s těmito akciemi.

Tento článek byl napsán