The transition to a climate-neutral industry in Europe is essential to combat the climate crisis. At the center of this industrial transformation is the production of steel, cement and chemicals. A new study by Fraunhofer ISI for the EU Commission has examined the impacts of the industry transition on the European energy system in different scenarios. The study shows that Europe’s industry in 2050 will need substantial amounts of green hydrogen and a corresponding transport infrastructure, even with strong electrification of process heat. In the interview, the study’s author, Dr. Tobias Fleiter, explains the results and reveals where the green hydrogen for our industry could come from in the future.

What could Europe’s energy system look like in 2050?

Tobias Fleiter: The good news is that our analysis shows that a greenhouse gas reduction of at least 95 percent is possible for European industry by 2050. But a lot has to happen for this transformation to succeed. For example, we need to implement the circular economy, and achieve higher energy and material efficiencies as well as the rapid introduction and dissemination of climate-neutral production processes in many sectors, in some cases even before 2030.

The European energy system in 2050 will be characterized by a much higher demand for electricity and hydrogen. In industry alone, the demand for electricity could rise from just over 1,000 TWh in 2019 to between 1,500 and 1,850 TWh in 2050, depending on the scenario. The demand for hydrogen could be between 1,350 and 1,800 TWh in 2050, depending on the degree of electrification. The demand for hydrogen could be significantly lower if the basic chemicals and steel industries relocate individual energy-intensive production steps outside of Europe. However, total energy demand, which today also includes many fossil energy sources, will be lower in 2050 than it is at present because of increasing energy efficiency.

We use the energy system model METIS in the study to examine a CO2-neutral European energy system. Our focus is on the role of CO2-neutral industrial production and its impacts on the hydrogen and electricity system. The modeling is based on a cost optimization of the system. The future demand for electricity and hydrogen is given exogenously and the model then calculates the system with minimal overall costs including the expansion and use of renewable energies, transport capacities between countries and storage systems.

What influence will the transformation of industry have on the energy system?

Tobias Fleiter: CO2-neutral industrial production will require large amounts of CO2-neutral hydrogen and electricity, especially to provide process heat and replace the natural gas used today, but also to supply the chemicals industry. A few intermediate products of the chemical industry (and steel production) are responsible for a large proportion of the hydrogen needed. At the same time, it is very uncertain how the chemical industry will set up CO2-neutral value chains globally in the future. This is why we calculated a scenario variant in which we assume that intermediate products like ammonia, methanol and ethylene as well as sponge iron are imported to Europe. This would result in the demand for hydrogen being lower by about 900 TWh.

Which countries could produce green hydrogen for Europe’s industry at the lowest cost?

Tobias Fleiter: The results paint a relatively clear picture: The key prerequisites for the CO2-neutral system are large amounts of photovoltaic and wind power deployed at the best locations in Europe. Our model sees the biggest capacities for producing green hydrogen in France, Spain, the United Kingdom and Norway. If the hydrogen scenario occurs, Finland could also become one of the major hydrogen exporters to meet the demand in Europe. If renewable energies are not located cost-optimally in European countries, it would be economical to import hydrogen from North Africa or the MENA region to meet Europe’s demand. Green hydrogen is produced using electrolysis, mainly in regions that have high RE potential and low energy demand. The hydrogen is then transported to the demand centers via a pipeline network. These demand centers include Germany and the Netherlands, for example, which have high population density and a basic chemicals industry.

According to the study, under this cost-optimal perspective, there would be no significant production of green hydrogen in Germany, because other countries have better production conditions. Should Germany give up on producing its own green hydrogen?

Tobias Fleiter: When interpreting the study, it is important to remember that the scenarios are based on a purely techno-economically optimized development of the CO2-neutral energy system in Europe, in other words, without considering any political and societal restrictions to its implementation. In this respect, this study is in no way a prediction and cannot be a direct template for policymaking. But it can be used as input to develop strategies. And the key message for the EU and its member states is that integrating the European system (through the trading of electricity and hydrogen) has cost advantages over national solutions.

It should not come as a surprise to anyone that it is more cost-efficient to produce green hydrogen at locations with high potential for wind and solar energy. Nevertheless, policymakers have to weigh up how much Germany, for example, wants to and should be dependent on other (European) countries. If, in addition, there are expectations that the expansion of renewables in many countries will not proceed as quickly as calculated, Germany should of course still try to produce its own green hydrogen. Systemic resilience is therefore the key buzzword here and should not be neglected. In the end, the good news is that, in theory, Europe fulfills the prerequisites to supply itself cost-efficiently with green hydrogen independently of third countries.

Více informací

- Odkaz na studii

- Further information about the METIS project

The capacity of the clean hydrogen market is expected to expand to 170 million tons (MT) of hydrogen by 2030 and reach 600 MT by 2050, according to Deloitte’s 2023 Global Green Hydrogen Outlook.

It is estimated that over $9 trillion in cumulative investments will be required in the global hydrogen supply chain, with developing economies accounting for $3.1 trillion of this investment. The decline in spending on oil and gas, if redirected toward clean hydrogen, could easily help achieve the required financing.

The report highlights the challenges around the costs and production of green hydrogen, the importance of developing a value chain, and ways to drive investments.

The emergence of hydrogen applications will create incentives to relocate certain activities and manufacturing processes, such as steel and ammonia-based fertilizer production, to regions with the lowest production costs.

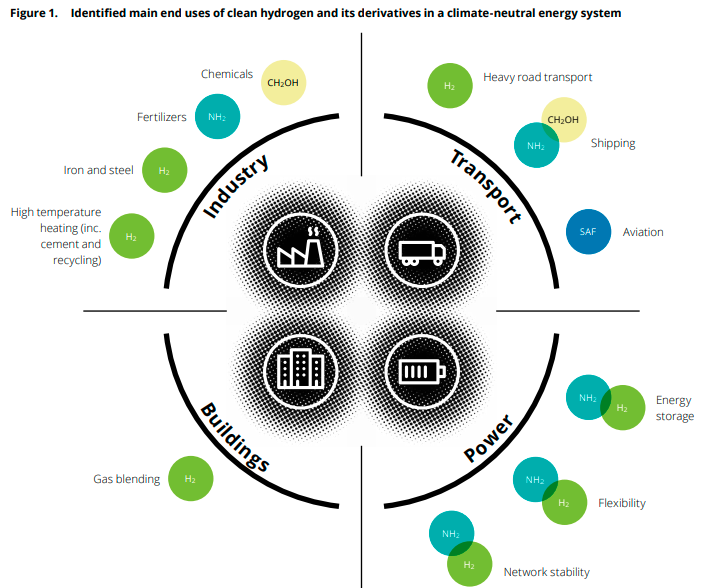

By 2050, the industrial sector (including iron and steel, chemicals, cement, and high-temperature heating), as well as the transportation sector (including aviation, shipping, and heavy road transport), will account for 42% and 36%, respectively of the total demand for clean hydrogen.

By decarbonizing existing applications and developing new uses, it is estimated that up to 85 gigatons of CO2 emissions can be mitigated by 2050.

By 2050, four regions will collectively account for approximately 45% of global hydrogen production and 90% of trade.

North Africa and Australia are expected to have the highest export potential, with 44 MT and 16 MT of hydrogen, respectively, surpassing their domestic demand. They will be followed by North America (24 MT of hydrogen) and the Middle East (13 MT of hydrogen).

Demand by Sector

According to Deloitte’s outlook, the initial growth in demand for hydrogen will be driven by the decarbonization efforts in existing industrial applications, specifically in fertilizer production, before expanding to encompass new sectors.

In Deloitte’s analysis, hard-to-abate sectors can drive the bulk of long-term demand for green hydrogen.

In 2050, the demand for clean hydrogen in industries such as iron, steel, and others are projected to exceed 250 MT, representing 42% of the total demand for hydrogen.

Full decarbonization of the transport sector will likely require 215 MT of clean hydrogen by 2050, 36% of the total demand for clean hydrogen.

Hydrogen can also play an essential role in the power system for energy storage and flexibility services, requiring another 125 MT of hydrogen by 2050.

The injection of hydrogen into the existing natural gas transport and distribution network can be a potential solution to slightly lower the carbon footprint of gas consumption in buildings. However, Deloitte’s outlook suggests a limited role for blending as electrification rapidly displaces natural gas consumption in this sector in a net-zero environment.

Green Hydrogen Costs

Costs will play a pivotal role in driving the adoption of clean hydrogen. Currently, producing and transporting clean hydrogen is more expensive compared to its fossil fuel-based counterparts.

Based on the analysis, the production cost of green hydrogen is projected to range from $2.50 to $5/kg by 2025, which is at least $1.5/kg higher than grey hydrogen. Key clean hydrogen technologies like electrolyzers and storage are still in their early stages, while alternatives like steam methane reformers and coal gasification plants have the advantage of decades of infrastructure and implementation.

In an emerging market, uncertainties regarding the market’s future can discourage private investments.

Developing the Clean Hydrogen Value Chain

Creating a global clean hydrogen market at a rapid pace presents an unprecedented challenge. This challenge involves decarbonizing the existing hydrogen supply entirely.

According to Deloitte’s projections, there will be an increase in the adoption of hydrogen in new applications more than six-fold within the next three decades. On the demand side, transitioning to hydrogen may necessitate significant changes in industrial and transportation technologies, such as fuel cells and sustainable aviation fuel (SAF) production, some of which still have considerable potential for further advancement.

Furthermore, governments and companies must establish a comprehensive global infrastructure for transporting and storing hydrogen on a large scale.

Countries like Australia, Chile, Mexico, regions in northern and sub-Saharan Africa, and Middle Eastern countries, blessed with abundant high-quality renewable energy resources, have particularly favorable conditions to emerge as major exporters of green hydrogen.

Overcoming Bottlenecks for the Production

For densely populated economies, the availability of land can pose a challenge.

Expanding green hydrogen production on a large scale often necessitates extensive land areas to establish solar and wind installations to generate renewable electricity.

Since solar and wind power offer a relatively low energy density per unit of surface area, the requirement for available land can hinder the widespread deployment of green hydrogen in densely populated countries like Japan, South Korea, and certain parts of Europe.

Some industrialized nations may face difficulties in meeting their hydrogen demand solely from domestic sources. In contrast, many developing countries can capitalize on their abundant reserves of sun-drenched land.

Emergence of a Clean Hydrogen Market

Deloitte’s outlook reveals that to achieve global climate neutrality by the Middle of this century, the clean hydrogen market is expected to undergo several stages of growth in the coming decades. Here are the different stages:

Do roku 2030: During this period, the market expansion is anticipated to be driven by the replacement of current grey hydrogen production with clean hydrogen. Noteworthy programs that exemplify this support include the U.S. Inflation Reduction Act and Infrastructure Investment and Jobs Act, the Australian Clean Energy Finance Corporation, the EU Fit-for-55 package, and Hydrogen IPCEI program, as well as the Japanese demand-side research and development (R&D) support programs such as the Green Innovation Fund.

Od roku 2030 do roku 2040: The clean hydrogen market is expected to experience significant growth as new applications for hydrogen emerge, driving an increase in demand. To fully unlock the potential of long-distance trade, a new transport infrastructure will be developed, including dedicated pipelines, port terminals, and storage facilities. By 2040, nearly 75 MT of hydrogen is projected to be traded.

Od 2050: The international hydrogen market will reach a mature stage. With ongoing cost reductions, the capacity for green hydrogen production will expand on a massive scale to keep up with the growing demand throughout the 2040s. This expansion will be crucial in meeting the increased demand for hydrogen as the market evolves.

Global Trade Connecting Key Exporting and Importing Hubs

By 2030, the global trade of clean hydrogen among major regions is projected to reach over 30 million metric tons (MT), accounting for approximately 19% of global consumption. However, due to limited transport infrastructure capacity initially, early trade activities will mainly occur between neighboring regions.

According to the report, the Middle East, North Africa, and Australia will swiftly leverage their abundant, low-cost supply to become key players in the global hydrogen market. In the early years, the Middle East will lead the global trade, exporting more than 13 MT of hydrogen by 2030. It will be followed by North Africa and Australia, both benefiting from substantial potential in cost-competitive green hydrogen production.

Deloitte’s outlook highlights that China, Europe, Japan, and Korea will emerge as some of the largest importers during the market expansion phase.

By 2050, the trade volume could increase by more than threefold to reach 110 MT, and relations between regional hubs are expected to solidify to help form a global market.

New Market and Multiple Opportunities

The trade of clean hydrogen on a global scale has the potential to generate substantial benefits in terms of economic development, competition, efficiency, and overall energy security. According to Deloitte’s projections, the global hydrogen market is expected to reach $1.4 trillion by 2050, with interregional trade accounting for $280 billion of the total.

As clean hydrogen becomes a primary driver of growth, the overall market size can experience significant expansion. Starting from a baseline of $160 billion in 2022, which solely comprises carbon-intensive hydrogen, the market is estimated to grow to over $640 billion by 2030 and further increase to $1.4 trillion by 2050.

Ensuring a robust and accountable certification system for clean hydrogen is another crucial prerequisite for the market’s growth. This requires clear, transparent methodologies and a comprehensive technical infrastructure that enables accurate tracking.

Global alliances to facilitate the transfer of know-how and best practice and to establish local value chains are likely needed as well to help bolster the ramp-up and rapid establishment of international hydrogen markets.

According to a new report published by the United States Agency for International Development, India’s strategic advantages, including abundant renewable energy resources, existing consumption markets, and favorable investment opportunities, position it as a potential global green hydrogen hub.

Earlier, the European Commission had proposed a detailed new framework for green hydrogen producers within the EU and from other countries exporting to the region to ensure it is produced using renewable electricity.